About Us

+ Years

Experience

About Thillai Shri MR Chits Private Limited

Building Trust for Generations

Welcome to Thillai Shri MR Chits, where tradition meets trust. Established in 2022, we have been a cornerstone of the financial growth and stability of our community.

Our journey began with a simple yet profound vision: to provide reliable and accessible financial solutions that empower individuals and businesses alike.

+65

+65

Who We Are

- Vision

- Mission

- Values

We envision a future where financial inclusion is not just a concept but a reality. Our goal is to bridge the gap between conventional banking and the needs of the underserved, providing a platform where everyone can achieve their financial aspirations.

At Thillai Shri MR Chits, our mission is to offer transparent, efficient, and customer-centric financial services. We are committed to fostering a culture of trust and mutual benefit, ensuring that every member feels valued and secure.

- Integrity: We uphold the highest standards of integrity in all our actions.

- Commitment: We are committed to delivering exceptional service and value to our members.

- Community: We believe in the power of community and strive to create a supportive network for our members.

- Innovation: We embrace innovation to continuously improve our services and meet the changing needs of our members.

Thillai Shri MR Chits

What We Offer

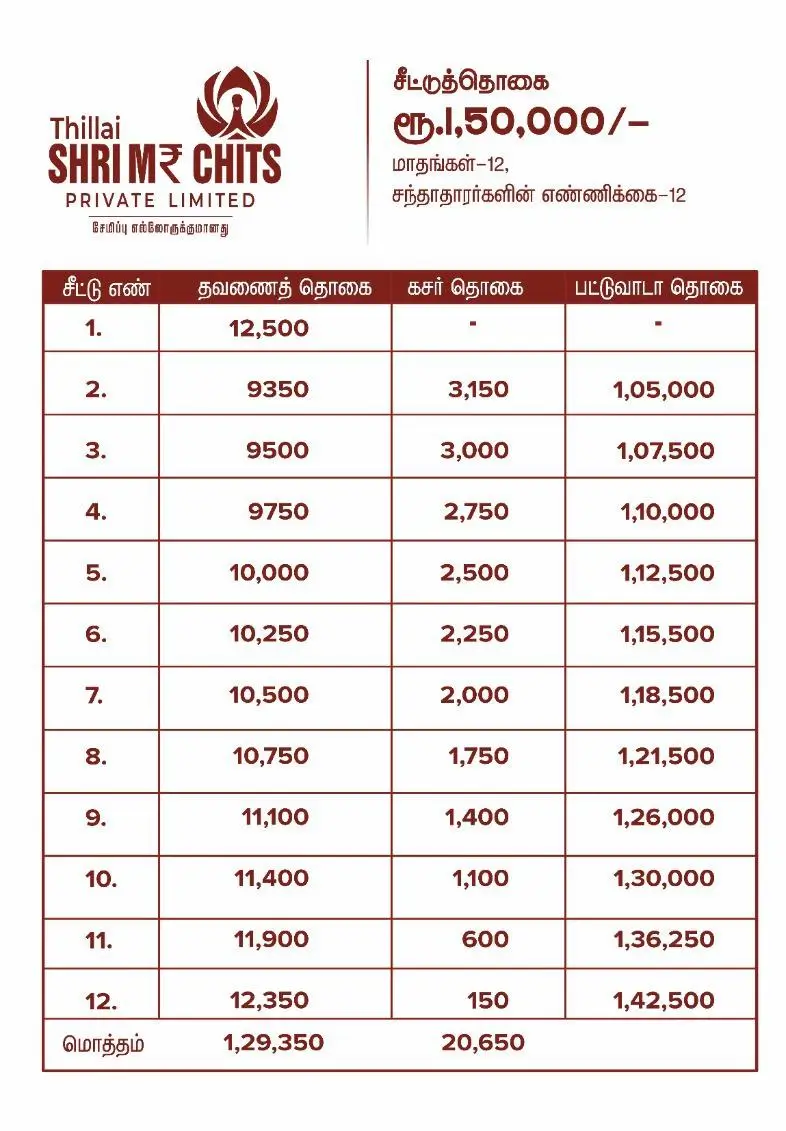

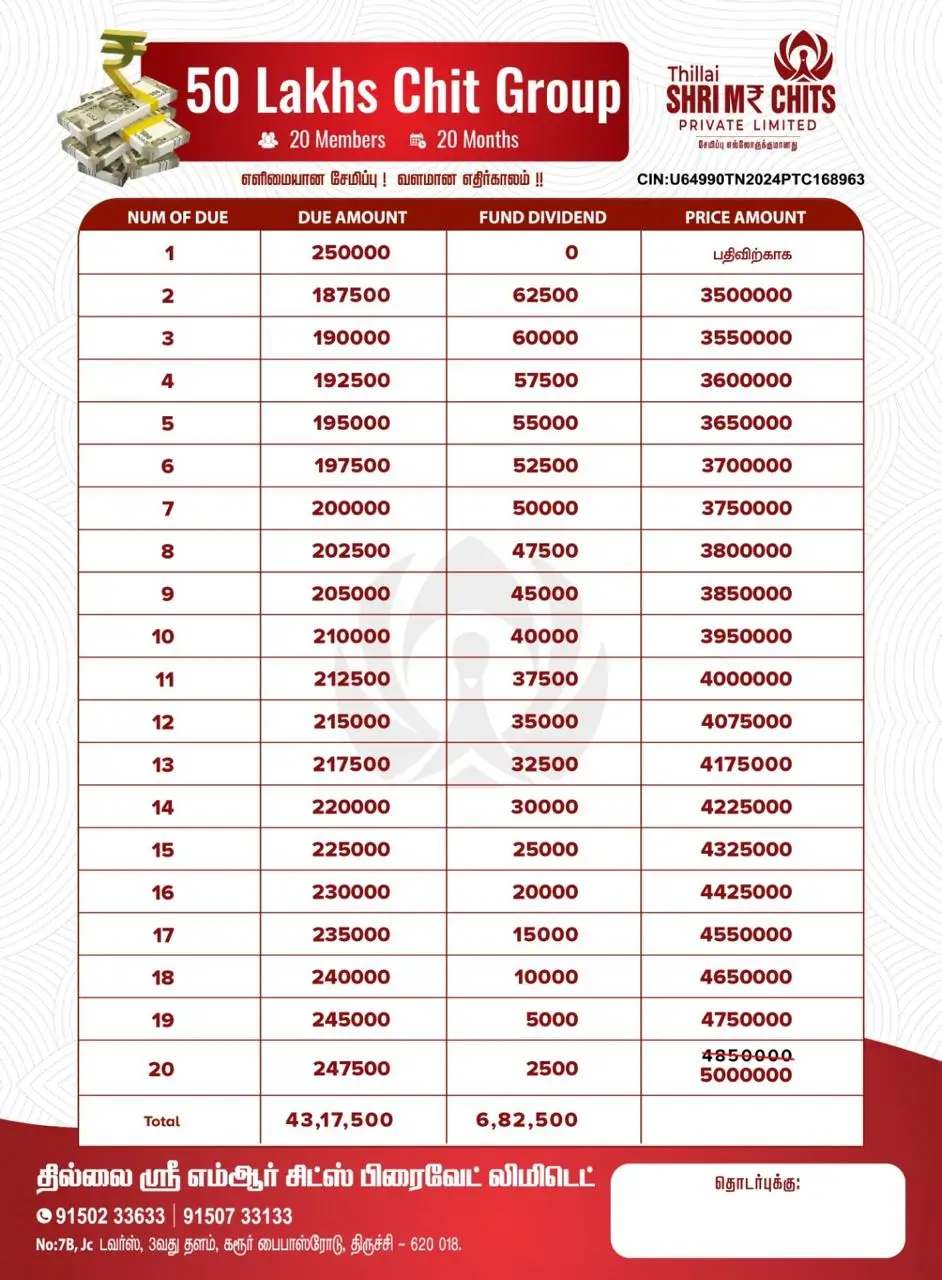

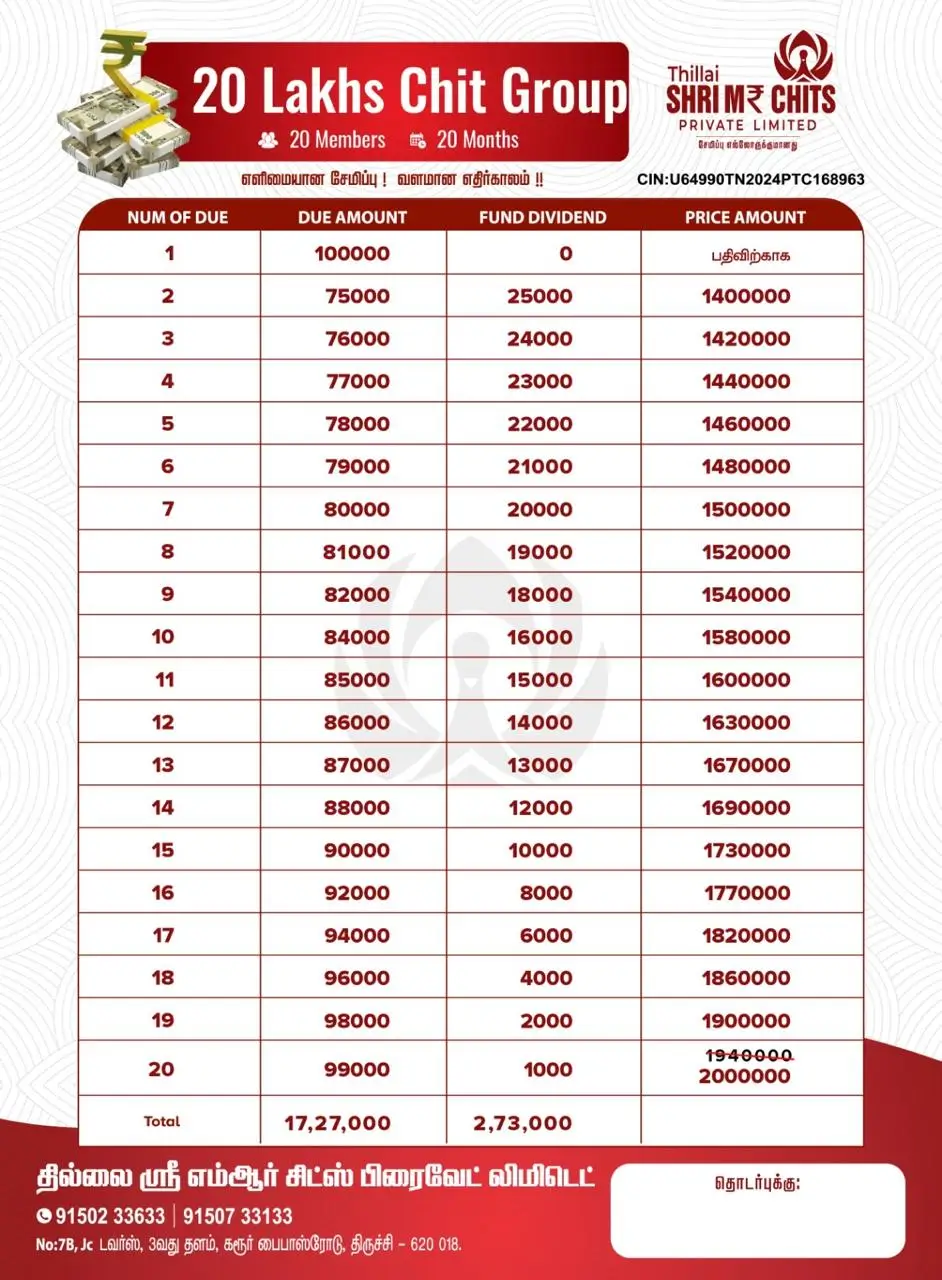

Tailored Chit Fund Plans

offer a range of chit fund schemes designed to meet diverse financial needs, from personal savings to business investments.

Transparent Operations

Our processes are transparent, and we keep our members informed at every step, ensuring clarity and trust.

Customer-Centric Approach

Our members are at the heart of everything we do. We listen, understand, and adapt to their evolving needs.

Financial Advisory

Our team of experts provides sound financial advice to help our members make informed decisions.

Our Team

Our team is a blend of experienced professionals and young enthusiasts who share a common passion for financial empowerment. With a deep understanding of the chit fund industry and a commitment to excellence, we work tirelessly to ensure our members' success.

Founder & Managing Director

MR. MOHAN KUMAR

Mr. Mohan Kumar was born on January 31, 1983, in Trichy and earned his MBA. He has built a career spanning multiple sectors. He started his career at SBI Cards from 2001 to 2007, then followed by a stint at Religare from 2007 to 2010. Since 2010, he has been with an investment management company. Alongside his corporate journey, Mohan has been actively involved in managing chit funds for the past 25 years. He has demonstrated strong leadership qualities and adept finance management skills

Co-Founder & Director

MRS. REVATHI MOHAN KUMAR

Mrs. Revathi, born on September 2, 1985, holds an M.Com degree and has excelled in Finance. She began her career at SBI Cards from 2003 to 2007, followed by 25 years in banking until 2022. In 2022, she became a director in a chit fund company (Partnership), then founded her own company in 2023. Revathi is known for integrity, transparency, and excellence, guiding our company to deliver top-tier financial solutions.

Benefits of Chit Funds

- Borrowing on Short Notice: You can borrow money quickly by winning the bid.

- Saving in Installments: Allows saving money in regular, manageable amounts.

- Prioritizing Savings: Joining a chit fund helps prioritize savings over other avoidable expenses.

- Convenience: No stringent formalities, making it easy to participate.

- Popular Method: Chit funds are a widely-used method for both saving and borrowing.

- Safety and Reliability: MR CHIT, a prestigious PSU, ensures 100% safety, reliability, and transparency in operations.

- Investment Safety: MR CHIT guarantees the safety of subscribers’ investments.

- Assured Funds in Crisis: Provides a guaranteed sum of money during emergencies.

- Easy Cash Access: Chit funds offer quick access to hard cash.

- Interest-Free Money: A way to obtain money at 0% interest.

Comparing Chit Funds with Banks & Others

| Benefits | Chit Funds | Banks & Others |

|---|---|---|

| Flexible Savings and Borrowing | Start with savings and convert into a borrowing instrument as needed. | Choose between savings and borrowing options, like savings accounts, FDs, or loans. |

| Freedom to Use Funds | Subscribers can use the funds as they wish. | Loans are for specified purposes, like home loans, vehicle loans, or business loans. |

| Interest on Borrowing | Borrow from your future savings based on mutuality. | Banks and other NBFCs lend at higher rates after adding interest and service charges. |

| Return on Savings | Risk-free compared to other financial intermediaries. | The high cost of operations and prevailing interest rates affect returns. |

| Tax | Dividends are taxable, and GST is applicable. | Interest earned from savings accounts, FDs, etc., is subject to tax. |

How

Chit Funds Work

Chit funds can help people save or borrow money for big expenses like weddings, building houses, starting or running a business, and education. It's important to choose the right chit group based on your ability to set aside extra money each month. This helps both you and the chit fund company avoid problems when it's time to give out the prize money or make monthly payments.

Get in touch